Easy Ways to Generate Extra Cash for a Move

It is likely no big secret that moving is expensive. From prepping, preparing and cleaning your old house to boxing and transporting your stuff (and sometimes even your family!), and then finally setting up, starting up and furnishing your new home, it can definitely feel like the expenses never ever stop. Between cleaning fees, security deposits, start-up charges, gas and tolls, shipping costs and so much more, there is so much you have to cover up front before any type of reimbursement starts to roll back in. And even then, reimbursements don’t likely cover everything (if you get reimbursed at all!). We’ve moved enough times now that the financial shock of a move has (kinda) worn off, but that certainly doesn’t mean we enjoy the never-ending stream of expenses and the impact it has on our bank accounts for the 3-6 months afterward. Thankfully though, over the years, we’ve honed in on several easy strategies that allow us to generate a good bit of extra cash in the months and weeks leading up to a move. These aren’t huge, complicated get-rich-quick ideas, but rather small steps (that anyone can do!) to significantly offset the steep costs associated with moving. Let me share our “secrets” with you!

1. Sell Your Stuff

Most of you know I like to have large garage sales before we move (see my best tips here!). Not only do I find it helpful to get rid of stuff I know we don’t want in the new house (why pack it, move it, and unpack it if we don’t want it?), but a decent garage sale can often yield $200-$400. This time around, I don’t have time or energy (#thirdtrimester) for a large yard sale, but I am still selling off big items (e.g., rugs, shelves, patio set, etc) via Facebook Marketplace. Each transaction yields between $50-$100 and that definitely starts to add up! Even generating a few hundred dollars from your unwanted stuff can easily cover line items like a move-out paint job or house cleaning, meaning those items don’t have to be covered from your bank account!

2. Cash Out Your Points

This is one of our very favorite strategies! We use credit cards that allow us to accrue points which can then be redeemed for a variety of items. During the entire duration of our assignment, we don’t touch those points. We let them grow and grow and grow. And then right before we move, we resist all the cool stuff we could buy with the points and just cash them out for Visa debit cards. These cards can then cover pretty much anything we need them to, from gas/tolls/food on the road, to nuisance staples for the new home like trash cans, lightbulbs, etc.

When we move into our new home, our points balance is usually back at zero; and then we spend the next few years building it up to do it all over again on our follow-on move. As long as you can be really diligent about not touching those credit card points, it’s an oh-so-easy way to literally generate cash out of nowhere!

3. Deposit Your Change

Our change strategy is very similar. We have a large glass jar that sits on our bedroom dresser. Again, for the entire length of our tenancy, we throw all spare change into that jar. Sure, we fish out quarters every now and then to pay off our son’s allowance; but on the whole, the jar goes un-touched and just builds until it’s time to move again. In the weeks before we move, we have a little tradition of lugging it all to the bank and depositing it for an instant cash flow! Although this may not seem like it generates much, 3 years worth of stockpiling quarters DOES add up!

4. Shut Down Services, Subscriptions, and Memberships

When moving out of a house, you will likely need your main utilities (water, electricity) until the very end, but consider other things you can cancel or shut down sooner in order to save some cash. Many companies will pause, suspend or out-right cancel memberships and services during a move, and all it takes is a simple phone call to determine their policies. Also, many will often pro-rate your final bill based on usage, giving you some instant cash back. Here are few things to consider:

- Internet and TV – If you have unlimited data via your mobile plan, consider shutting down your Internet and TV weeks before you move. You’ll be too busy packing to watch TV anyway 😉

- Meal subscription boxes – If packing/planning leaves you no time or energy to cook, cancel these subscriptions and only re-start them once you’re settled into you new home and ready to cook again. Also, don’t forget to cancel your CSA box so you don’t end up with a heap of fresh veggies you can’t eat or use before you go!

- Other subscription boxes – Perhaps you get a monthly craft box, clothing box, cleaning supply box, etc. You are likely not going to be able to utilize these for a month or two before and after your relocation. So just go ahead and pause or cancel them and only re-start them once your finances have recovered!

- Memberships – Gym memberships, child classes, pool/golf memberships, etc often require a 30-day cancellation policy. To avoid paying for a month of services you won’t use, be sure to shut these down at least 30-days (or whatever that membership policy requires) before you leave town!

5. Stockpile Gift Cards

Gift cards have become pretty standard thank-you, birthday, Christmas (and more!) gifts these days, and I can’t say I mind it! So much that in the year or so leading up to our next move, I will often hoard these gift cards, and not use a single one. Then, when we can no longer cook in our kitchen because it’s all packed up or I need to buy new towels for all the bathrooms, I have a stockpile of restaurant and store gift cards to use up. In fact, I just used a bunch of Target gift cards to buy items for the baby’s nursery because it all finally went on sale…and I didn’t pay a penny for it all! No matter what you’re buying, relying on gift cards really softens the blow when it feels like all you’re doing is spending and spending some more!

TIP! Know someone who is moving? Gift cards to a favorite store or restaurant will go a long way in making their transition easier!

6. Do What It Takes To Get Your Security Deposit Back

Moving out of a rental can be exhausting. And when you’re faced with carpets to clean, walls to paint, and appliances to scrub, you may be tempted to throw your hands up and say “whatever, that’s what the security deposit is for!” But let me tell you…getting a full security deposit back is like winning a mini lottery. Although it’s money that is technically yours and owed back to you, you tend to forget about about that huge lump of cash you forked over when you first moved in. Getting all of it back means that it can either cover your next security deposit or pay off a lot of the other expenses you’ve incurred during your move. Although we always do a ton to our homes (paint, hang pictures), we hustle hard to ensure we get every last penny back!

Do You Have a Move Coming Up?

Check out my comprehensive collection of moving resources!

- The Complete “Smooth Move” Printable Moving Binder System

- Countdown to a Military PCS | Our Moving Timeline

- How to Declutter Your Entire Home Before a Move

- Easy Ways to Generate Extra Cash for a Move

- The BEST Moving Advice From Experienced Military Spouses

- Moving Essentials | What You REALLY Need Moving From One Home to Another

- How (& Why) to Plan Your Furniture Layout Before Moving Into a New Home

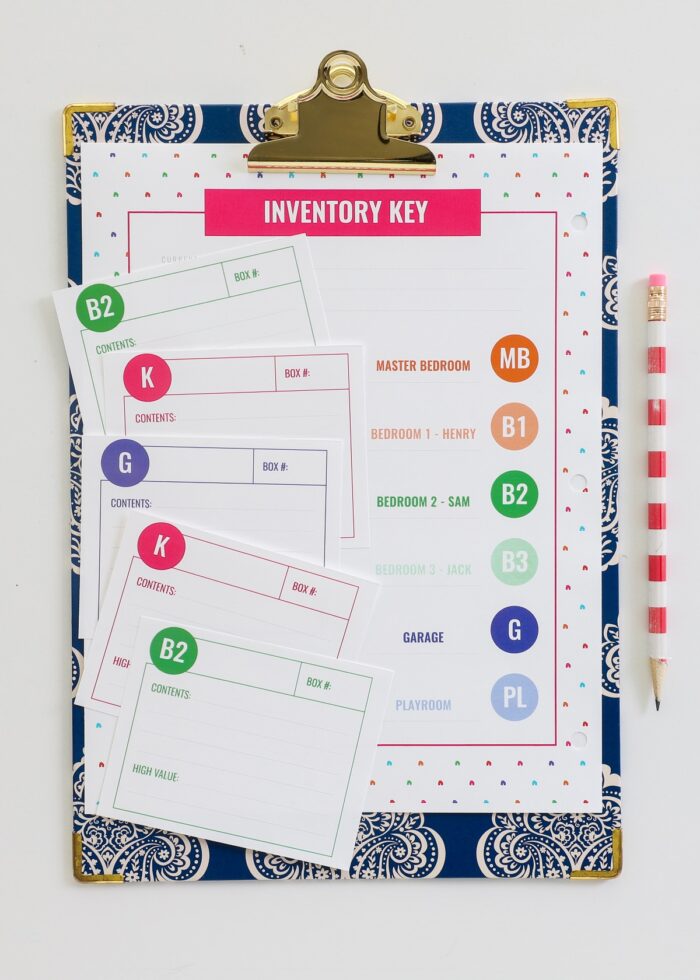

- How (& Why) To Color Code Your Moving Boxes

- How to Fill Nail Holes In Your (Rental) Walls

Moving is stressful enough as it is, that if you can reduce some of the financial burden, the whole experience can go a little smoother! I can’t emphasize enough that every bit helps, especially when you think about all the “little” costs associated with shutting down or starting up a new home. While some of these may be no brainers or even perhaps seem insignificant, we’ve found that when used all together, they make a significant impact on our finances surrounding each relocation!

Megan

3 Comments on “Easy Ways to Generate Extra Cash for a Move”

So many good ideas, Megan! Hope you enjoyed your time in good old SD and the boys got to spend time at the Zoo and Wild Animal Park. I’m sure you have an exciting plan for your trip cross-country. I’m looking forward to using some of your organizational ideas once I finish get my house de-cluttered. Still trying to make donations every month to clear stuff out. Wishing you both a smooth trip, and an easy birth! Aloha, Tenney

Thank you so much for all the great tips on finding “hidden” money. It’s funny how all the “pennies” you collect such as the change jar, credit card points, reducing or shutting down membership services eventually add up to substantial amounts of money. These tips are applicable to all people not just those who are looking to move.

I have been told and seen for myself that garage sales don’t really work anymore. A lot of work for VERY little cash. Also Facebook Marketplace can be hit or miss. Since I was counting on these to provide some moving money, it was disappointing to find out.